personal property tax car richmond va

Personal property taxes are billed annually with a due date of december 5 th. Pay Personal Property Taxes.

Virginia Cracking Down On Farm Use Tags For Vehicles Wset

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal.

. If you can answer YES to any of the following questions your vehicle is considered by. Personal Property Tax. Example Calculation for a Personal Use Vehicle Valued at 20000 or Less.

Press J to jump to the feed. Sales Tax State Local Sales Tax on Food. The personal property tax is calculated by multiplying the assessed value by the tax rate.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the.

In neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly amended Virginia. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for. Taxpayers now have until August 5 2022 to pay these taxes without incurring penalty or interest.

Boats trailers and airplanes are not prorated. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed. Personal property tax car richmond va.

So I moved to Richmond in August and after I registered my car to VA I got a letter about the personal property tax and they wanted me to mail them. If your vehicle is valued at 18030 the total tax would be 667. An example provided by the City of Richmond goes like this.

Personal property tax car richmond va. Personal Property taxes are billed annually with a due date of December 5 th. Personal property tax applies to any vehicle normally garaged or parked in Prince William County - even if the vehicle is registered in another state or county.

Drury Plaza Hotel Richmond Richmond Va 2021 Updated Prices Deals. All online in person or mail payments madepostmarked on or before August 5 2022 will not. COVID-19 IMPACT TO VEHICLE VALUES FOR 2022.

350100 x 10000. Assessed value of the vehicle is 10000. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday.

Virginia law makes vehicles with. The 10 late payment penalty is applied December 6 th. Tangible Personal Property Tax 581-3503.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Real property tax on median home.

Questions answered every 9 seconds. Personal property tax bills have been mailed are available online and currently are due June 5 2022. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231.

My office has used the same assessment. At the calculated PPTRA rate of 30 you would. Offered by City of Richmond Virginia.

Taxpayers can either pay online by visiting RVAgov or mail their payments. Apply the 350 tax rate. Personal Property Taxes.

3504 Carolina Ave Richmond Va 23222 Mls 2209767 Zillow

Pay Online Chesterfield County Va

2601 Courthouse Rd Richmond Va 23236 Mls 2209150 Zillow

Virginia Vehicle Sales Tax Fees Calculator

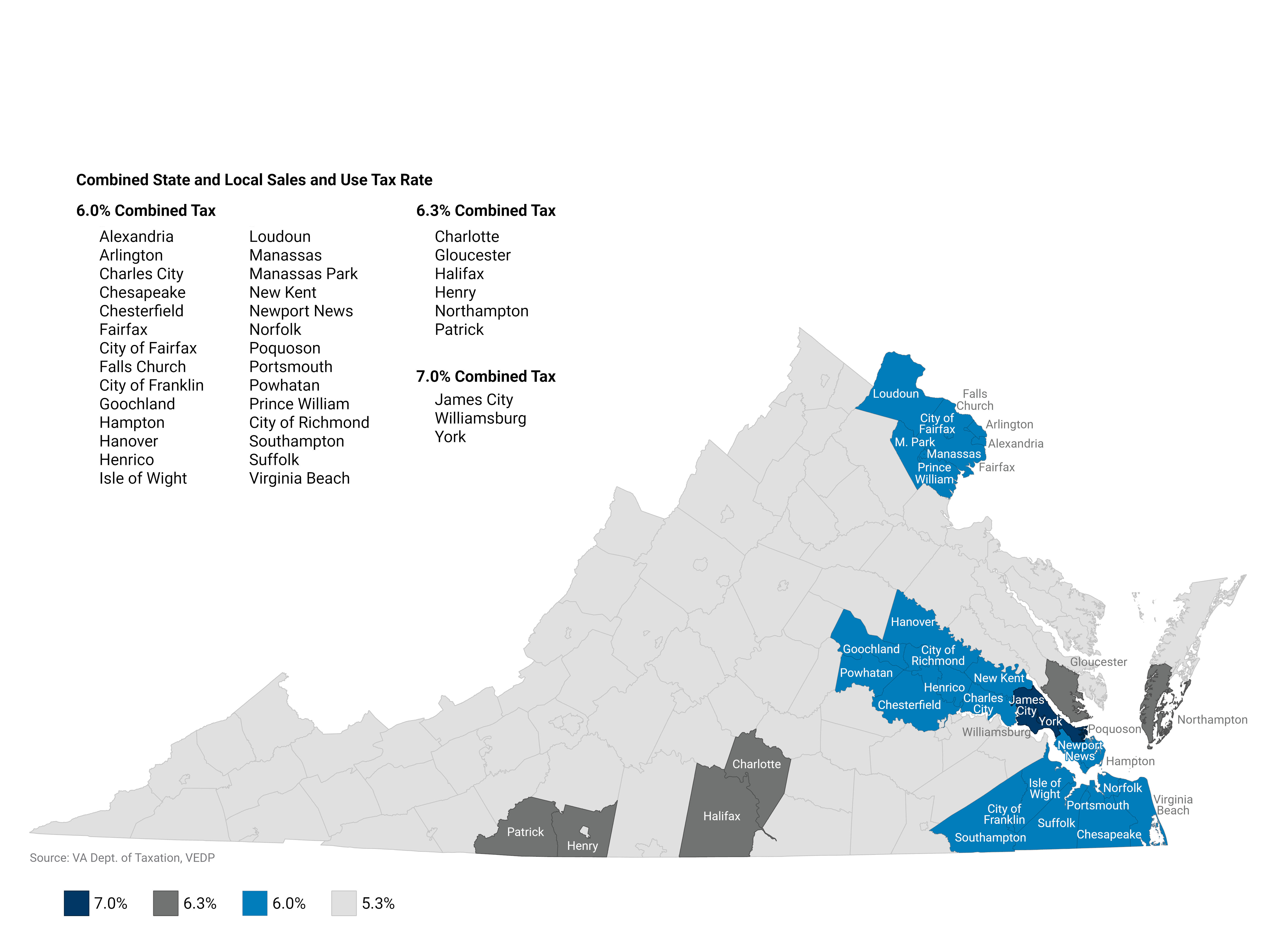

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Virginia Vehicle Sales Tax Fees Calculator

Virginia Vehicle Sales Tax Fees Calculator

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

Village South 801 Holly Spring Ave Richmond Va Townhomes For Rent Rent

413 Bonruth Pl Richmond Va 23238 Realtor Com

Virginia Sales Tax On Cars Everything You Need To Know

2209 Loreines Landing Ct Richmond Va 23233 Realtor Com

413 Bonruth Pl Richmond Va 23238 Realtor Com

413 Bonruth Pl Richmond Va 23238 Realtor Com

Virginia Department Of Motor Vehicles